More pension provision – lower taxes and social security contributions.

The impact on taxes and social security contributions is identical in all four schemes (Compensation Plan, Bridging Plan, Supplementary Plan, One-Off Contribution Plan). This is how it works:

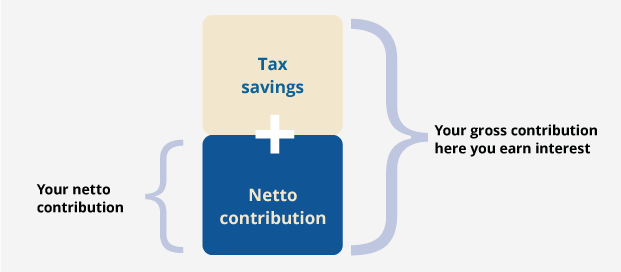

Your contributions are deducted from your gross income – this is called deferred compensation. This means you don’t pay any taxes on your contributions today, and as your taxable income decreases, other taxes also decrease. This is because the taxes are calculated after your contribution has been deducted from your income. Up to a limit of 4% of the statutory Contribution Assessment Ceiling (CAC) , contributions are also exempt from social security contributions. The result? You are paying in less than is actually deposited into your retirement provision!

The exact amount of your tax benefit depends on your personal situation: income, tax bracket, children

What to look out for!

- 1. Benefits subject to taxation and social security contributions: Of course, the government will not pass on its money – once benefits are paid out, they are subject to tax and social security contributions. Overall, it still pays off: your tax rate in retirement is usually lower than what it was during working life. And social security contributions are also lower most of the time: because there are no contributions deducted for unemployment benefits and state pension. However, your health insurance and long-term care insurance must still be paid in full (employer’s and employee’s share of the contribution).

- 2. Impact on the state pension: For contributions up to 4% of the CAC, you are saving social security contributions today. This also means that less money is paid into the compulsory state pension fund, which in turn decreases your legal benefits.